- Get link

- Other Apps

Modern technology, computers and sound tools make it attainable for almost anyone to create and file their very own music in a house studio. A PC or pc with a soundcard in, is enough to get started and there are many good makes of soundcard available on the market too. If you are considering of starting to construct your personal residence recording studio, here's a small record of things and factors you have to to think about. It is not gospel and loads of people get by on much much less technology, but fascinated by the following points will assist you take into account all the options. All of it begins with the soundcard in your computer. In case your laptop got here with a soundcard built-in already, then it is advisable overlook about utilizing it - completely! These primary fashions are low-cost to make and supply and will only be appropriate for producing sound, not recording it. You will want to consider an entry-level audio interface card or machine to get essentially the most out of residence recording with your laptop. Look for a model that offers top quality analog to digital conversion processors as it will make the sound better.

Are recording studio costs breaking your financial institution? You are positively not the one one. When you throw in the price of the engineer, the musicians, and plenty of other elements recording studio prices can climb fairly high. So how precisely do you cushion the damage whereas still getting essentially the most out of the sessions? Easy, you do things a unique manner. Having had my dwelling studio working for quite a while now I have realized that relating to the professional studios there are just a few ideas I can provide to lower the costs which we will talk about below: I can not stress this enough. In case your goal is to spend the least amount of cash for prime quality recordings you'll want to realize that almost all studios charge by the hour. For those who walk into that studio spending 2 hours trying to figure out where to start out you may be seeing quite a heavy invoice once it's all stated and executed with. Earlier than you even contemplate booking a session be taught your material until you may say it in your sleep. This can make an enormous distinction with the recording studio costs as a result of the less time spent within the studio the less it's a must to pay. Many studios are likely to have a minimal amount of time you could guide the session for however how I see it is if you spend 2 hours on one song it is manner higher than spending three or 4 hours. If you are really good you might full 2 songs throughout the timeframe given which is a win-win.

Cuomo signed New Yorks electronic recording law which permits electronic recording of instruments affecting real property by recording officers in New York State Chapter 549 of the Laws of 2011. Credit Line Mortgages in New York 1999pdf.

Hans Haacke Firebrand Gets His First U S Survey In 33 Years Published 2019 In 2021 Conceptual Art Conceptual Manhattan Real Estate

Hans Haacke Firebrand Gets His First U S Survey In 33 Years Published 2019 In 2021 Conceptual Art Conceptual Manhattan Real Estate

The Office of the City Register records and maintains all property-related documents including deeds mortgages and leases for every borough except for Staten Island.

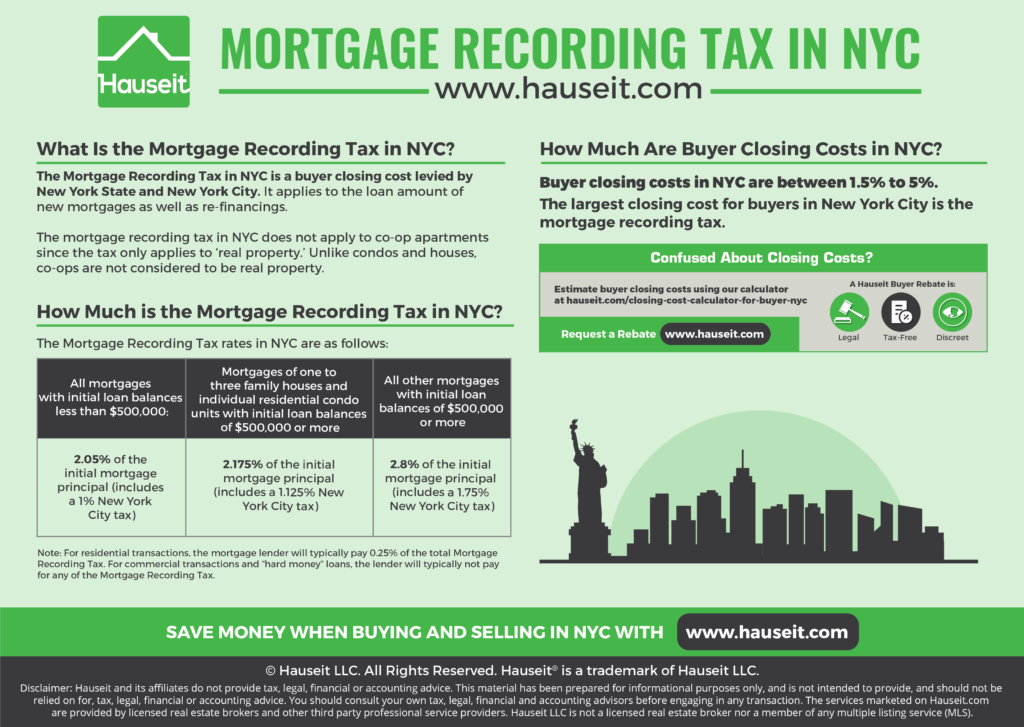

Recording open mortgage on title new york. Electronic Recording for Real Estate in New Yorkpdf. The tax rate varies depending on the location of the mortgaged property the highest rate of tax being 280 for each 100 of principal indebtedness secured when a mortgage on commercial property in New York City secures 500000 or more. Free New York County Recorder Of Deeds Property Records Search.

The New York City Registers Office collects this tax for all the boroughs except Staten Island. In September 2011 Governor Andrew M. NY City mortgage recording tax.

The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays 025 of the MRT. Buyer pays for recording Deed and Mortgage docs Seller pays for recording of releases Local transfer tax determined by municipal ordinance Seller pays State and County Buyer pays loan policy charges Seller pays any abstract charges fees vary Negotiable usually Buyer pays for instruments of conveyance and financing Seller pays for instruments to clear title Negotiable Buyer pays recording. There are many other local optional taxes.

NYC Department of Finance Created Date. It explains how to anticipate and minimize these taxes when structuring the sale purchase or mortgaging of an interest in realty. Statutory recording charges new york bronx kings and queens counties recording and indexing deeds mortgages recording fee 3200.

Learn more about the mortgage recording tax including tax rates. The borrower has the right to have the mortgage discharged from the title once the debt is paid. The mortgagee shall within forty-five days deliver the note and the mortgage and where a title is registered under article twelve of the real property law the registration copy of the mortgage and any registration certificates in the mortgagees possession to the mortgagor or the mortgagors designee making such payment and request if required.

The mortgagee shall within forty-five days deliver the note and the mortgage and where a title is registered under article twelve of the real property law the registration copy of the mortgage and any registration certificates in the mortgagees possession to the mortgagor or the mortgagors designee making such payment and request if required as aforesaid. Transfer and Mortgage Recording Taxes in New York Title Closings references the statutes regulations decisions and rulings associated with the taxes imposed on the transfer of real property in the state of New York. Home Equity Theft Prevention Act 2007pdf.

Find New York County residential property records including deed records titles mortgages sales transfers ownership history parcel land zoning structural descriptions valuations tax assessments more. Mortgage recording tax must be paid to record a mortgage in New York State unless there is a statutory exemption from the tax. 256 Affidavit Indefinite Mortgage 275 Affidavit Assignment of Mortgage 339-ee Affidavit NYC Unit Mtg 500K or More 339-ee Affidavit NYC Unit Mtg Less than 500K Mtg Tax - 339-ee Worksheet - Commercial XLS.

Mezzanine Finance Practice Notepdf. Whether defects are in the transfer of the note or of the mortgage whether a foreclosure is judicial or non-judicial13 and. 100-175100 based on - 500K home value and type of property.

Therefore the effective Mortgage Recording Tax rates you pay as a buyer in NYC are 18 for loans under 500k and 1925 for loans of 500k or more. Last Dollar Endorsements and Capping The New York Mortgage 1995pdf. Mortgage Recording Tax Primer 2015 updated 2019pdf.

The Richmond County Clerk gathers this tax for Staten Island. Title problems affecting the validity of foreclosures and foreclosure sales arising from secondary market sales and securitization of mortgage loans can be classified on three dimensions. If the person recording the mortgage claims an exemption from the tax the appropriate affidavit must be filed with the mortgage documents.

Third Party Notification for Real Property Taxes Application. Mtg Tax - 339-ee Worksheet - Residential XLS. Starting September 23 2012 the laws effective date recording officers may receive and record digitized paper.

A The recording officer shall record and file such certificate or certificates together with the certificates of acknowledgment or proof and shall note on the record of the mortgage the book and page containing such record of such certificate or certificates or the serial number of such record in the minute of the discharge of such mortgage made by the officer upon the record. Visit the Richmond County Clerk to record property documents in Staten Island. Checklist for Document Recording Author.

So that a buyer cannot unwittingly buy property subject to a mortgage mortgages are registered or recorded against the title with a government office as a public record. Property owners must provide the relevant mortgage recording tax information when the mortgage documents are recorded. MT-15 or the Mortgage Recording Tax Return is a New York State Department of Finance form that must be filled out correctly for your mortgage to be recorded.

Army Memorandum For Record Template Luxury 15 Memorandum Of Record Army Memorandum Template Letterhead Template Memo Format

Army Memorandum For Record Template Luxury 15 Memorandum Of Record Army Memorandum Template Letterhead Template Memo Format

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Http Www Nysba Org Workarea Downloadasset Aspx Id 47751

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Http Www Nysba Org Workarea Downloadasset Aspx Id 47751

Foreclosure Vs Short Sale Avoid Foreclosure If At All Possible Avoid Foreclosure Foreclosures Shorts Sale

Foreclosure Vs Short Sale Avoid Foreclosure If At All Possible Avoid Foreclosure Foreclosures Shorts Sale

Http Www Nysba Org Workarea Downloadasset Aspx Id 47751

Http Www Nysba Org Workarea Downloadasset Aspx Id 47751

400 Subscribers In 5 Hours World Record Complete 1k Subs Today Promo Videos Youtube Video Sponsor

400 Subscribers In 5 Hours World Record Complete 1k Subs Today Promo Videos Youtube Video Sponsor

Buyer Under Contract Letter Template Transaction Coordinator Real Estate Information Letter Templates

Buyer Under Contract Letter Template Transaction Coordinator Real Estate Information Letter Templates

Car Owner Pays Off Loan Wonders Why Bank Hasn T Sent Title Money Matters Cleveland Com

Car Owner Pays Off Loan Wonders Why Bank Hasn T Sent Title Money Matters Cleveland Com

Aditya Birla Finance Personal Loan Personal Loans Personal Finance Personal Loans Online

Aditya Birla Finance Personal Loan Personal Loans Personal Finance Personal Loans Online

Https Www Dfs Ny Gov System Files Documents 2019 12 Bf419text 0 Pdf

Right Of Rescission The Truth About Mortgage

Right Of Rescission The Truth About Mortgage

Ny Satisfaction Of Mortgage Complete Legal Document Online Us Legal Forms

Ny Satisfaction Of Mortgage Complete Legal Document Online Us Legal Forms

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo

Fifteen years in the past, when you needed a great recording, you would not even think about asking this query. You'd know the one reply for getting recording could be to go to a studio. However over the past decade in a half, it has turn out to be more and more simpler to make quality recordings your self. Today, this is a question virtually each musician asks themselves. And when you're a musician and YOU'RE NOT ASKING YOURSELF THIS QUESTION, you better start. Making completely nice sounding dwelling recordings is finally potential. And it's even easier and cheaper than most people are aware. With the proper info and steerage, it is easy to get the appropriate gear, low-cost to purchase it, and simple to operate it and make ultimate recordings. As a musician myself, I understand how essential it's to retain creative management over my music. And recording my self is the best way to do. I don't have to fret about money and time constraints like I would if I went to a studio where I was paying the standard charges of $35-80 per hour. Not solely that, I don't have to worry about some guy who would not even hearken to my kind of music destroying my combine, attempting to make my tune sound like his favorite type of music.

The magic of the recording studio has usually mystified even the most seasoned professionals. With all of the knobs, switches and buttons on various gear and huge format consoles, no marvel confusion units in to most non-techies. Many people, particularly artists, composers, producers, and engineers, will find yourself placing collectively their very own studio for writing and pre-production, with some ultimately deciding to take the plunge and create a full-fledged recording advanced that's capable of recording main albums. This article will attempt to shed some light on the concerns to bear in mind when making a studio, be it a small house studio or a professional recording studio. Is size vital? Some could say it's so however this is not all the time the case. The dimensions of the studio are crucial. A room too large might turn out to be over-reverberant or stuffed with unwanted echoes. A room too small might sound tight and unnatural. It will be important that the room size and room sound is relevant to the type of music you are recording. You do not need to go into a really small tight room to file BIG rock drums. Though, huge room sounds may be achieved by including exterior reverb results to simulate rooms at a later time when crucial.

Comments

Post a Comment