- Get link

- Other Apps

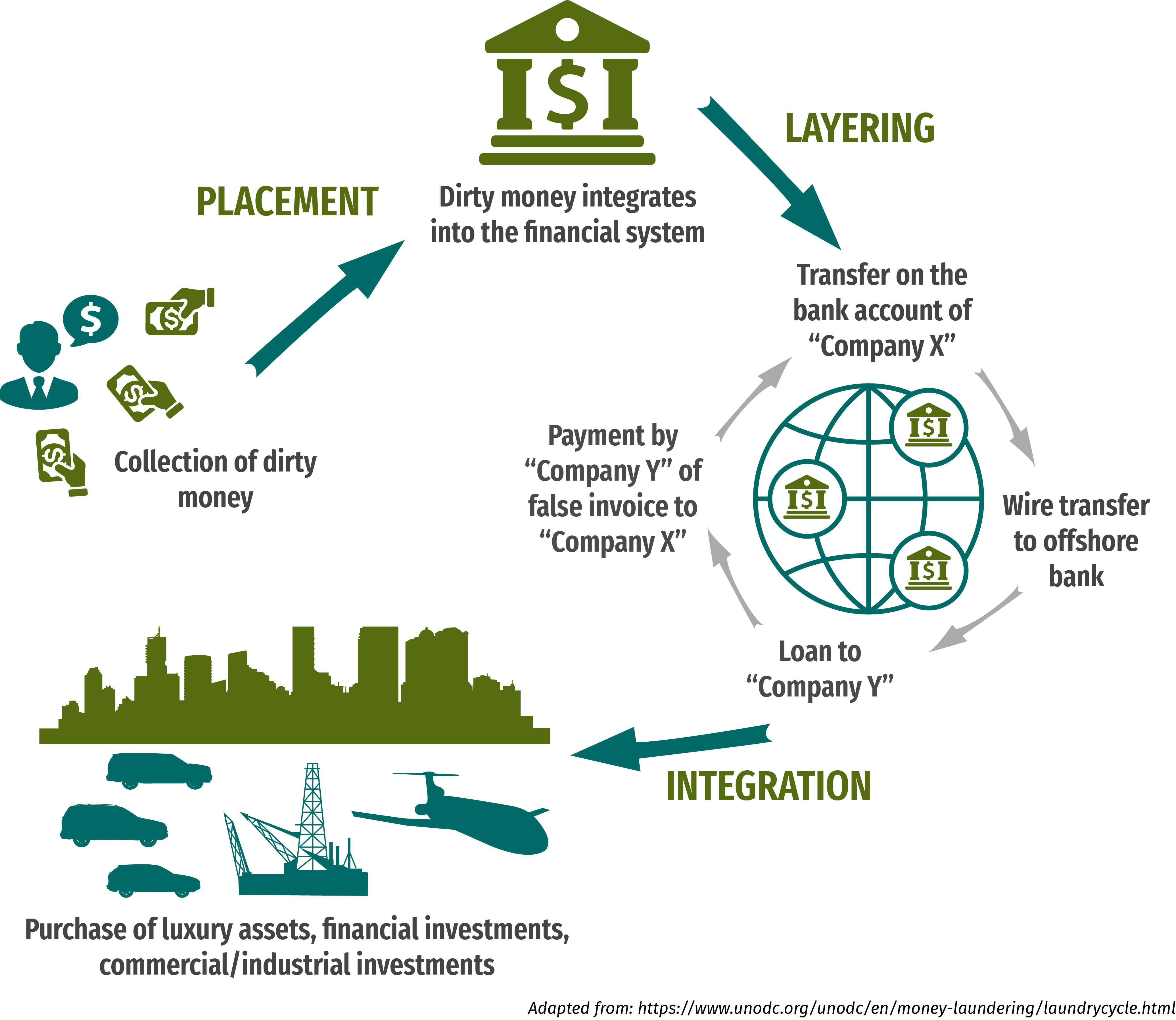

The idea of cash laundering is essential to be understood for those working in the financial sector. It's a course of by which dirty cash is converted into clear money. The sources of the money in precise are felony and the cash is invested in a manner that makes it appear to be clear cash and conceal the identity of the prison part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new prospects or sustaining current customers the obligation of adopting adequate measures lie on every one who is a part of the organization. The identification of such component in the beginning is easy to cope with as an alternative realizing and encountering such situations later on in the transaction stage. The central bank in any country gives full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to discourage such situations.

Money laundering typically includes three stages. The placement stage involves the phys-.

Whales Sharks And Flounders Conceptualizing Real World Money Laundering Cfcs Association Of Certified Financial Crime Specialists

Placement layering and integration stage.

Which step in the money laundering process do law enforcement efforts focus. Since money laundering is an illegal activity therefore one can only estimate the amount of money laundered every year. Placement layering and integration. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups.

The first stage in the process is placement. It is critical to bear in mind however that it is more than a bloodless exercise in accounting. Placement This is the movement of cash from its source.

This is the act of moving the ill-gotten funds into a financial institution. Dirty money appear legal ie. A Office foreign asset control OFAC B securities and exchange commission SEC C international monetary fund IMF D financial action task force on money laundering FATF The banks secrecy act requires financial institutions to file reports for currency transactions greater than.

Methods and Markets 25 Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. 3 Stages of Money Laundering. The International Monetary Fund for example had stated in 1996 that the aggregate size of money laundering in the world could be somewhere between 2- 5 of the worlds gross domestic.

However it is important to remember that money laundering is a single process. There are many ways of money laundering which are explained in the. Money laundering is under control through the increased efforts of bank employees and FinCEN C.

Money laundering is the process of making illegally-gained proceeds ie. Investigating and prosecuting money laundering and forfeiting criminal assets can be a long arduous and complex process. There is no doubt that with the enactment of the Money Laundering Act 2004 the Nigerian Government has taken a bold step in its efforts to fight against money laundering in the country.

Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. However it is effort and resourcefulness may not bear the required results if the well-known problems of enforcement of law in the country are not adequately addressed in the provisions. The Money Laundering Process.

A robust and resilient anti-money laundering and combating of terrorism financing AMLCFT regime is the first step towards being able to implement effective legal regulatory and operational measures. Moving the funds from direct association with the crime Layering ie. Placement layering and integration.

How much money is laundered every year. The stages of money laundering include the. Disguising the trail to foil pursuit Integration ie.

When the crime of money laundering is fought organized crime is fought. The money laundering cycle can be broken down into three distinct stages. Making the money available to the criminal from what seem to be legitimate sources In reality money laundering cases may not have all three stages some stages could be.

Money laundering is restricted to financial institutions and therefore weakens the banking system B. Money laundering has a minimal impact on society as a. The institution may be anything from a brokerage house or bank to a casino or insurance company.

The fight against money laundering. The EU has since updated the AMLD four times as. This overview presents recommendations made by the OECD in relation to Latvias efforts.

Typically it involves three steps. The first step is called placement. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation.

And at the same time hiding its source. In 1991 building on the FATF standards the EU adopted an anti-money laundering directive AMLD to prevent criminals from taking advantage of the free movement of capital in the internal market and to harmonise the Member States efforts to tackle money laundering. There are three stages involved in money laundering.

Placement can take place via cash deposit wire transfer check money order or other methods.

Anti Money Laundering Blacklist Spells Trouble

Anti Money Laundering And Counter Terrorism Financing

Example Of A Gary Hendin Money Laundering Operation Accessing Real Download Scientific Diagram

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

9 Effects Of Money Laundering Summarized Download Table

Anti Money Laundering In Indonesia What You Need To Know

Three Stages Of Money Laundering Download Scientific Diagram

Shell Companies And Money Laundering How To Combat Them

Tnrc Introductory Overview Why Is Money Laundering A Critical Issue In Natural Resource Corruption Pages Wwf

About Business Crime Solutions Money Laundering A Three Stage Process

What Is Anti Money Laundering Quora

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

Anti Money Laundering And Counter Terrorism Financing

The world of rules can look like a bowl of alphabet soup at instances. US money laundering regulations aren't any exception. We now have compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting agency centered on protecting financial services by lowering risk, fraud and losses. We've got huge financial institution expertise in operational and regulatory threat. We have a powerful background in program management, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many adverse penalties to the group due to the dangers it presents. It will increase the chance of major dangers and the opportunity price of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment